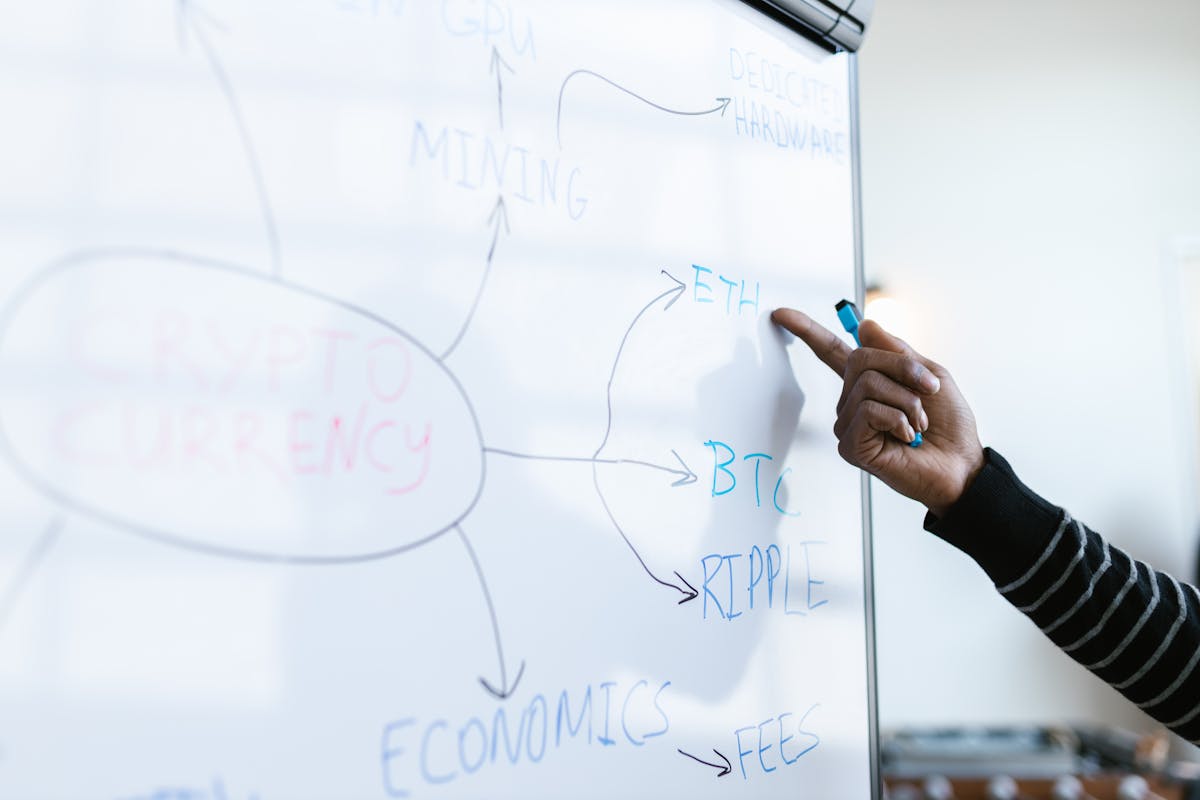

Why Bitcoin’s Post‑Halving Derivatives Boom Is Redefining Digital Gold in 2026

In early 2026, Bitcoin behaves less like a fringe experiment and more like a macro‑sensitive, institutionally traded instrument, yet it remains driven by cyclical narratives, on‑chain signals, and regulatory uncertainty that keep analysts divided on what comes next.

Bitcoin’s 2024 halving once again cut the block subsidy in half, reducing the pace of new BTC issuance and reinforcing its programmatic scarcity. But unlike prior cycles, this halving occurred in a market where U.S. spot Bitcoin ETFs, deep regulated derivatives markets, and algorithmic trading desks dominate flows. The result is a hybrid asset: part commodity, part macro trade, and part high‑beta tech play.

From 2024 through early 2026, trading volumes on the Chicago Mercantile Exchange (CME), offshore venues, and ETF platforms have repeatedly spiked around macro events, regulatory headlines, and on‑chain inflection points. Meanwhile, miner economics have been upended, triggering consolidation and a shift toward industrial‑scale operations that resemble energy‑intensive data centers more than the hobbyist mining rigs of Bitcoin’s early days.

Mission Overview: Understanding the Post‑Halving Market Regime

The “mission” of Bitcoin’s halving schedule is simple but profound: every ~210,000 blocks, the reward paid to miners is reduced by 50%, capping total supply at 21 million BTC. This hard‑coded monetary policy is intended to emulate, and arguably improve upon, the scarcity properties of gold.

In the 2024–2026 window, that mission interacts with a complex market structure:

- Lower new supply: Fewer newly minted coins entering the market each day.

- Higher financialization: More BTC is “wrapped” in ETFs, custodial solutions, and derivatives collateral.

- Global macro linkage: Bitcoin increasingly responds to interest‑rate expectations, liquidity cycles, and geopolitical risk, much like gold and growth stocks.

“Bitcoin is transitioning from a purely speculative asset to a globally traded monetary network whose supply schedule is entirely transparent. Halvings are the heartbeat of that schedule.” — Adapted from commentary by institutional crypto analysts in 2025.

For traders, the post‑halving regime is less about a guaranteed “four‑year bull run” and more about understanding how shrinking new supply interacts with derivatives positioning, ETF flows, and broader risk appetite.

Technology and Market Infrastructure Behind the Derivatives Boom

Bitcoin’s core protocol has changed slowly, but the surrounding market infrastructure has evolved rapidly. The institutional derivatives boom rests on three technological pillars: robust custody, low‑latency trading systems, and sophisticated risk‑management tooling.

1. Spot ETFs and Institutional Custody

The approval and growth of spot Bitcoin ETFs in major markets have made it possible for pension funds, RIAs, and corporate treasuries to gain BTC exposure without holding private keys. Funds such as BlackRock’s and Fidelity’s U.S. spot Bitcoin ETFs (launched in 2024) accumulated billions in assets under management within their first year, according to SEC filings and industry reports.

These ETFs rely on specialized custodians that use:

- Multi‑signatures (multisig): Requiring multiple keys to move funds, reducing single‑point‑of‑failure risk.

- Hardware security modules (HSMs): Tamper‑resistant cryptographic devices, similar to those used in banking.

- Geographically distributed cold storage: Offline key storage across multiple secure facilities.

2. Regulated Futures, Options, and Swaps

On venues like CME, Bitcoin futures and options contracts allow institutions to gain or hedge exposure without touching physical BTC. Open interest and funding rates around the 2024 halving and subsequent price spikes suggest that directional and basis trades (cash‑and‑carry arbitrage) are now central to Bitcoin’s price discovery.

- Futures: Standardized contracts with expiry dates; widely used for hedging ETF holdings.

- Options: Calls and puts enabling structured strategies around halving‑related volatility.

- Perpetual swaps (on offshore venues): Non‑expiring contracts whose funding rates signal bullish or bearish leverage.

3. Algorithmic and High‑Frequency Trading (HFT)

Co‑located servers, cross‑exchange arbitrage bots, and machine‑learning‑driven strategies exploit inefficiencies between spot, ETF, and derivatives markets. These systems react within milliseconds to:

- On‑chain data (large transfers, miner flows).

- Macro headlines (rate decisions, inflation releases).

- Funding‑rate and options‑skew shifts that signal crowding.

For readers who want to understand derivatives more deeply, books such as “Options, Futures, and Other Derivatives” by John C. Hull provide a rigorous foundations‑level overview.

Scientific and Economic Significance of Bitcoin’s Halving Cycles

From an economic‑science perspective, Bitcoin’s halving offers a rare natural experiment: a known future shock to supply in an otherwise free market. This has attracted attention from quantitative finance, macroeconomics, and complexity‑science researchers.

1. Programmatic Scarcity and the “Digital Gold” Thesis

Bitcoin’s stock‑to‑flow ratio — the ratio of existing supply to new annual issuance — rises abruptly after each halving. This mirrors, and eventually surpasses, the scarcity of precious metals. Proponents argue that, over long horizons, such scarcity underpins the “digital gold” narrative.

“Bitcoin is not just digital gold; it’s a live‑fire testbed for how markets price an asset with perfectly transparent supply.” — Paraphrased debate among macroeconomists and crypto analysts through 2025.

2. Market Microstructure: Liquidity, Volatility, and Price Discovery

Post‑2024 data suggest that institutional derivatives trading has:

- Deepened order books on major exchanges, especially around U.S. and European trading hours.

- Increased intraday volatility during macro announcements, as cross‑asset algos link BTC to equities, rates, and FX baskets.

- Shifted price discovery toward derivatives venues, with spot markets reacting to futures basis and ETF premium/discount.

3. On‑Chain Analytics as a New Data Science Frontier

Public blockchains turn market microstructure into an open dataset. In 2025–2026, research and trading desks have leaned heavily on on‑chain metrics such as:

- Realized price: Average cost basis of coins, used to identify capitulation and euphoria.

- Dormancy and coin days destroyed: Activity of long‑held coins, signaling conviction or profit‑taking.

- Whale accumulation: Changes in balances of large addresses and ETF custodians.

Social platforms like X (Twitter), YouTube, and newsletters from firms such as Glassnode and CryptoQuant routinely publish these metrics, which are then debated on forums like Hacker News and in long‑form explainers on sites such as CoinDesk and The Block.

Miner Economics and Industry Consolidation

The halving has the most direct impact on miners, whose block rewards are instantly cut in half. Unless mining difficulty adjusts downward or BTC prices rise, many operators experience severe margin compression.

1. Revenue Streams and Cost Structure

Post‑2024, miner revenues are a mix of:

- Block subsidies: Newly created BTC; now a smaller share of total revenue.

- Transaction fees: Increasingly important during periods of high on‑chain congestion (e.g., Ordinals and inscription spikes).

- Energy arbitrage and grid services: Miners co‑locating with stranded energy or participating in demand‑response programs.

Major costs include electricity, hardware (ASICs), cooling, operations staff, and financing expenses. As inefficient miners shut down after the halving, hash rate temporarily dips before recovering as larger players expand.

2. Consolidation and Geographic Shifts

In 2024–2026, publicly traded miners and well‑funded private firms have been acquiring distressed smaller operations, taking advantage of:

- Bulk ASIC purchases at scale.

- Long‑term power purchase agreements.

- Access to capital markets for debt and equity financing.

Regions with cheap, stable energy and relatively clear regulation — parts of North America, Scandinavia, the Middle East, and Latin America — have seen continued growth, while jurisdictions with abrupt policy shifts have lost hash rate.

3. Tools and Hardware for a Post‑Halving World

While industrial miners use custom ASICs and infrastructure, serious home miners and researchers often rely on efficient hardware and power monitoring tools. For example, high‑efficiency power meters and cooling solutions, or reading materials like “The Internet of Money” by Andreas M. Antonopoulos, can help newer participants understand the economic dynamics of mining and Bitcoin more broadly.

Macro Narrative: Bitcoin as a Macro‑Sensitive “Digital Gold”

In early 2026, Bitcoin’s behavior is tightly interwoven with global macro conditions. Traders monitor:

- Interest‑rate paths from the Federal Reserve, ECB, and other central banks.

- Inflation expectations and real yields.

- Geopolitical tension and capital‑control risks.

During risk‑off events, Bitcoin sometimes sells off alongside equities, contradicting the “pure safe‑haven” narrative. Over multi‑year horizons, though, its finite supply and resistance to debasement continue to attract capital from investors skeptical of fiat monetary policy.

“Bitcoin is evolving into a high‑beta macro asset with a unique supply schedule. It trades like a risk asset day‑to‑day but is increasingly held like digital gold year‑to‑year.” — Summary of 2025 commentary from macro hedge‑fund managers on LinkedIn and conference panels.

This dual identity explains why the post‑halving period can feature both violent drawdowns and spectacular rallies, often clustered around changes in liquidity expectations or ETF flow regimes.

Regulatory Overhang and Policy Evolution

While many jurisdictions treat Bitcoin itself as a commodity rather than a security, the broader crypto ecosystem faces active regulatory debate. This overhang influences institutional participation, lending practices, and the pace of financial product innovation.

1. Core Themes in 2024–2026 Regulation

- Custody rules: Capital requirements, segregation of client assets, and cybersecurity standards for custodians.

- Tax policy: Clarifying treatment of staking, lending yields, and frequent trading.

- Stablecoin and DeFi oversight: Banking‑style regulations for systemic stablecoin issuers; disclosure and compliance frameworks for DeFi front‑ends.

- Market‑abuse controls: Surveillance for wash trading, spoofing, and manipulation, especially on derivatives venues.

2. Impact on Derivatives and ETFs

Stricter margin rules and transparency requirements have generally been welcomed by large institutions, which prefer clear rulebooks. However, uncertainty around cross‑border enforcement and treatment of non‑Bitcoin tokens often spills over into BTC sentiment, as risk budgets are allocated at the portfolio level.

For detailed legal and policy analysis, readers often consult resources such as:

- Bank for International Settlements (BIS) reports on crypto and financial stability.

- Financial Stability Board (FSB) publications on global regulatory coordination.

- U.S. SEC and CFTC enforcement actions and guidance, accessible via their official websites.

Key Milestones in the 2024–2026 Bitcoin Cycle

The years following the 2024 halving have featured several notable inflection points that define this market cycle.

1. Halving Event and Immediate Aftermath

- Hash rate volatility as inefficient miners shut down, followed by recovery.

- Spikes in transaction fees when mempools briefly filled during speculative NFT‑like activity.

- Increased open interest on CME and major offshore derivatives exchanges around the event window.

2. Spot ETF Inflows and Outflows

Net inflows into spot ETFs in late 2024 and 2025 signaled rising institutional comfort with Bitcoin exposure. Periods of sustained net inflows coincided with uptrends in price, while sharp outflows often aligned with macro‑driven risk‑off episodes.

3. Derivatives Positioning Extremes

Early 2025 and late 2025 saw:

- Elevated funding rates and crowded long positioning in perpetual futures, followed by flush‑out corrections.

- Skewed options markets with high demand for out‑of‑the‑money calls during speculative phases.

- Rising put volumes as miners and ETF providers sought to hedge downside risk.

4. Social Media and Narrative Cycles

Throughout 2025–2026, narratives like “post‑halving supply shock,” “miner capitulation,” and “institutional FOMO” have trended on X and YouTube. Influencers publish on‑chain dashboards and derivatives heatmaps, while skeptics critique their methodologies on forums such as Hacker News and Substack.

Challenges and Risks in the Post‑Halving, Derivatives‑Driven Era

Despite its maturation, Bitcoin remains a volatile asset with structural risks that investors should understand. The derivatives boom amplifies some of these challenges even as it deepens liquidity.

1. Leverage and Liquidation Cascades

High leverage on perpetual futures can trigger cascade liquidations when price moves quickly. This dynamic can:

- Overshoot fair value on both the upside and downside.

- Increase realized volatility, making risk‑management difficult for newcomers.

- Cause spot ETFs and traditional investors to face mark‑to‑market stress based on derivatives‑driven moves.

2. Basis and Tracking Risk for ETFs

While ETFs track spot prices, hedging strategies using futures introduce basis risk — the spread between futures and spot prices. During stressed markets, this spread can widen, affecting:

- ETF performance versus underlying index.

- Hedge effectiveness for institutional portfolios.

- Market‑making risk on authorized participants.

3. Regulatory, Operational, and Security Risks

Key ongoing concerns include:

- Policy shock risk: Sudden regulatory announcements impacting exchange operations or capital flows.

- Operational failures: Exchange outages during volatile periods, as seen in prior cycles.

- Custody and key‑management errors: Though rarer at institutional level, still a focus of regulators and insurers.

To mitigate personal‑level risks, investors increasingly use vetted hardware wallets. For instance, devices like the Ledger Nano hardware wallet allow self‑custody with strong security assumptions when used correctly.

Conclusion: Bitcoin’s Hybrid Identity in 2026

In the aftermath of the 2024 halving, Bitcoin’s identity is more multifaceted than ever. It is:

- A scarce digital asset with a transparent, non‑discretionary supply schedule.

- A macro‑sensitive instrument whose price responds to interest‑rate expectations, liquidity, and geopolitical risk.

- A heavily financialized market where derivatives, ETFs, and structured products play a central role in price discovery.

The institutional derivatives boom has not eliminated Bitcoin’s volatility; it has changed its drivers. Cyclical narratives are now layered on top of ETF flows, hedging activity, and complex options positioning. For participants in 2026, understanding this interplay is more important than memorizing prior halving cycles.

Whether Bitcoin ultimately fulfills its “digital gold” promise, becomes primarily a high‑beta macro instrument, or settles into a role as collateral in a broader crypto‑financial system will depend on technology, regulation, and macro conditions over the coming decade. What is clear is that halvings will continue to mark major chapters in that story.

Practical Takeaways for Readers

For investors, technologists, and policymakers trying to navigate this post‑halving era, a few disciplined practices can help:

- Combine on‑chain and off‑chain data: Look at realized price, ETF flows, and derivatives positioning together rather than in isolation.

- Respect leverage: Treat high funding rates and crowded positions as risk indicators, not buy or sell signals in themselves.

- Diversify custody and counterparties: Use reputable exchanges, regulated products when appropriate, and secure self‑custody for long‑term holdings.

- Stay policy‑aware: Monitor announcements from major regulators and central banks, as they can rapidly change market structure.

For deeper learning, long‑form educational content from sources like Bitcoin Magazine, university‑level open courses on blockchain, and balanced skeptic/proponent debates on YouTube (for example, interviews hosted by channels like Bankless and Real Vision Finance) can provide valuable context beyond daily price moves.

References / Sources

Selected resources for further reading and data:

- CME Group – Bitcoin Futures and Options

- U.S. SEC – News and Spot Bitcoin ETF Filings

- CoinDesk – Bitcoin and Crypto Learning Hub

- Glassnode – On‑Chain and Derivatives Analytics

- BIS – “Cryptoassets: Implications for Financial Stability”

- Satoshi Nakamoto – “Bitcoin: A Peer‑to‑Peer Electronic Cash System”

- Academic literature on crypto‑asset pricing (various papers, Wiley)