How 60-Second Crypto Micro-Docs on TikTok & Reels Are Rewriting Web3 Education

Executive Summary: Micro-Documentaries Meet Crypto

Short-form video micro‑documentaries on TikTok, Instagram Reels, and YouTube Shorts are rapidly becoming a preferred way to learn about complex topics in 30–90 seconds. In crypto, this format is being used to explain DeFi protocols, staking, NFTs, layer‑2 scaling, and even crypto regulation in a highly compressed narrative.

This article analyzes how micro‑documentaries are reshaping crypto education, market narratives, and investor behavior. It offers a practical framework for founders, traders, and content creators to design effective short‑form explainer content while reducing the risks of misinformation, over‑simplification, and hype‑driven trading.

- Why short‑form “micro‑docs” are aligning with platform algorithms and crypto’s real‑time nature.

- How creators are compressing on‑chain data, tokenomics, and protocol mechanics into 60‑second narratives.

- A data‑driven view of which crypto topics perform best in short form.

- Risks: shallow learning, viral but inaccurate narratives, and regulatory scrutiny.

- An actionable playbook for crypto teams and creators to build credible, high‑retention micro‑documentary funnels.

The Rise of Crypto Micro‑Documentaries on TikTok, Reels, and Shorts

Short‑form platforms have evolved far beyond dance trends. A fast‑growing segment is the information‑dense explainer: creators delivering news, history, and niche education in under a minute. In crypto, this means:

- “Ethereum in 60 seconds” style protocol explainers.

- Quick breakdowns of DeFi hacks, airdrops, and governance votes.

- Short narratives on Bitcoin halving cycles or layer‑2 roadmaps.

- One‑minute case studies of Web3 games, NFT projects, and DAOs.

The key is a compressed narrative arc:

- Hook in 1–2 seconds (surprising stat, bold question, or visual).

- Context: what is this crypto topic and why it matters.

- Mechanics: how it works (at a high level).

- Implications: risks, opportunities, or “what this means for you”.

“Short-form video is becoming the default interface for financial discovery among younger users, and crypto is often their first speculative asset class.” — Aggregated insight from industry reports and platform trend data (2023–2025).

Why Crypto Is Perfectly Aligned with Short‑Form Video

Crypto and Web3 are structurally well‑suited to micro‑documentaries because they are:

- Real‑time and event‑driven: protocol upgrades, exploits, listings, and governance votes generate frequent story hooks.

- Visually explainable: token flows, staking yields, and bridged liquidity can be turned into simple charts and animations.

- Concept‑dense: terms like rollups, MEV, TVL, liquid staking invite concise definitions and analogies.

According to public traffic data from CoinMarketCap, Glassnode, and DeFiLlama (2024–2025), users increasingly arrive from social platforms, particularly TikTok and YouTube Shorts, during:

- New token launches and major airdrop announcements.

- Security incidents (exchange solvency concerns, bridge exploits).

- Macroeconomic catalysts (ETF news, regulatory actions).

Micro‑documentaries often act as the first touchpoint, with viewers later deep‑diving via long‑form articles, dashboards, or protocol docs.

Anatomy of a High‑Impact Crypto Micro‑Documentary

Effective short‑form crypto explainers share a repeatable structure that balances speed, clarity, and risk disclosure. Below is a practical blueprint that creators and teams can adapt.

1. Hook (0–2 seconds)

- A bold but factual statement: “This DeFi protocol lost $40M in 30 seconds.”

- A question: “Why is everyone suddenly talking about restaking on Ethereum?”

- A visual shock: quickly animating TVL going to zero or spiking 10x (with context).

2. Context (3–15 seconds)

Define the who/what/why using plain language and one or two terms of art:

“EigenLayer is a restaking protocol on Ethereum. It lets you reuse your ETH staking collateral to secure new services, earning additional yield—but also additional risk.”

3. Mechanics (15–45 seconds)

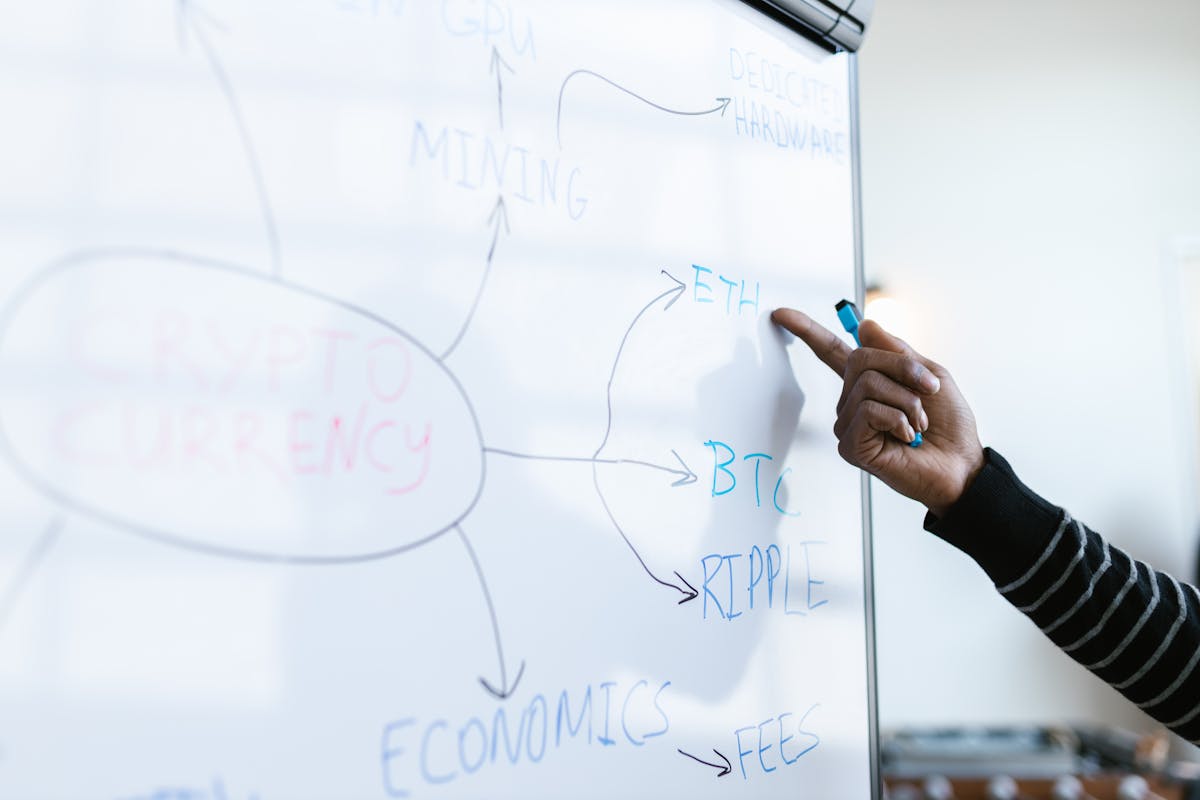

Use simple diagrams or overlays instead of jargon:

- Show ETH → LST (like stETH) → restaked into a new protocol.

- Visualize liquidity pools as two buckets of tokens shifting with trades.

- Indicate gas fees before/after layer‑2 compression.

4. Implications and Risk Flag (45–60 seconds)

Summarize benefits and risks without speculation:

- Benefits: lower fees, higher capital efficiency, more yield sources.

- Risks: smart‑contract exploits, liquidity crunches, regulatory changes.

Always include a clear disclaimer: “This is education, not financial advice. Do your own research and consider your risk tolerance.”

Visualizing Web3: Charts and Diagrams that Work in 60 Seconds

Strong micro‑docs rely on immediately legible visuals. Overly complex dashboards do not compress well into mobile vertical video. Below are examples of visual structures that translate smoothly from data platforms like DeFiLlama, Messari, or Glassnode into short‑form stories.

Example 1: TVL Growth Snapshot for DeFi Protocols

A common micro‑doc pattern compares Total Value Locked (TVL) across major DeFi protocols to explain their relevance.

| Protocol | Approx. TVL (USD) | Primary Category |

|---|---|---|

| Uniswap | $5–7B range* | DEX (AMM) |

| Aave | $8–12B range* | Lending |

| Lido | $25B+* | Liquid Staking |

| Curve | $3–5B range* | Stablecoin DEX |

*Approximate ranges based on public DeFiLlama snapshots during 2024–2025. Values move with market conditions; always consult live data.

Example 2: Gas Fee Before vs. After Layer‑2 Adoption

A 60‑second explainer on Ethereum layer‑2 scaling can show how rollups reduce gas fees for everyday users.

| Action | Mainnet Gas (Approx.) | Layer‑2 Gas (Approx.) |

|---|---|---|

| Token Swap (DEX) | $5–$25 | $0.10–$0.80 |

| NFT Mint | $10–$50 | $0.20–$1.50 |

| Bridge Deposit to L2 | $8–$30 | N/A (L1 cost only) |

Ranges are illustrative and vary with network congestion. In micro‑docs, creators typically show directional impact rather than precise figures and include a note that fees change over time.

High‑Performing Crypto Topics in Short‑Form Video

Analysis of trending crypto hashtags and public metrics from TikTok, Instagram, and YouTube between 2023–2025 shows that certain narrative archetypes consistently outperform others in terms of completion rate and shares.

| Content Archetype | Typical Length | Example Topics |

|---|---|---|

| Explainer Micro‑Doc | 45–75s | “What is restaking?”, “How rollups batch transactions” |

| News & Incident Recap | 30–60s | Hacks, rug‑pull breakdowns, regulatory actions |

| Historical Micro‑Doc | 60–90s | “1‑minute history of Bitcoin forks”, “The ICO boom in 60 seconds” |

| How‑To Snapshot | 30–45s | “How to bridge safely”, “3 checks before using a DEX” |

For Web3 teams, consistently publishing in 1–2 of these archetypes builds a recognizable educational brand without relying on aggressive price narratives or “get rich quick” framing.

A Strategic Framework for Crypto Micro‑Doc Content

To turn short‑form video into a serious acquisition and education channel, crypto teams should treat it like a product: with strategy, metrics, and feedback loops.

Step 1: Define Audience and Risk Profile

- Audience level: retail beginners, advanced DeFi users, or institutional professionals.

- Compliance constraints: jurisdiction, licensing status, and internal risk policies.

- Red lines: no yield promises, no unvetted tokens, clear disclaimers.

Step 2: Build Repeating Series

Series create expectations and improve binge‑watch behavior in algorithms:

- “DeFi Concept in 60s” — AMMs, lending, liquid staking, cross‑chain bridges.

- “One Minute Risk Check” — dissecting failures (Terra, FTX, notorious exploits).

- “On‑Chain in 30s” — quick data insights (spikes in active addresses or exchange flows).

Step 3: Script with an On‑Chain and Data‑First Mindset

Anchor claims in verifiable data:

- Use dashboards from Glassnode, DeFiLlama, or Dune for key metrics.

- Quote ranges and trends instead of precise point estimates when volatile.

- Link to data sources in captions or pinned comments.

Step 4: Design for Multi‑Platform Distribution

Repurpose a core script across TikTok, Reels, and Shorts with platform‑specific adjustments:

- TikTok: more native sounds and on‑screen text, algorithm‑sensitive hooks.

- Reels: alignment with Instagram carousels and stories for deeper dives.

- Shorts: strong synergy with long‑form YouTube breakdowns linked in description.

Step 5: Measure Beyond Views

Meaningful KPIs for crypto micro‑docs include:

- Completion rate and re‑watches (signal of clarity and engagement).

- Click‑throughs to docs, dashboards, or GitHub repos.

- Community growth: Discord, Telegram, or governance forum sign‑ups.

- Quality of questions in comments (surface real educational gaps).

Risks, Limitations, and Crypto‑Specific Concerns

While micro‑docs massively increase access to crypto education, they also introduce serious risk vectors that teams and creators must consciously mitigate.

1. Oversimplification and False Confidence

Crypto mechanisms—especially in DeFi, derivatives, and staking—are multi‑layered. Explaining them in 60 seconds risks:

- Understating smart‑contract, liquidation, or systemic risks.

- Over‑emphasizing yields without duration, volatility, or counterparty context.

- Creating an illusion of understanding that leads to over‑sized positions.

2. Virality of Incomplete or Misleading Narratives

Algorithmic feeds reward watch time and replays, not accuracy. In crypto, this can amplify:

- Unverified rumors about exchange solvency or token bans.

- Selective charts without time‑frame or denominator context.

- Price‑centered stories that ignore token distribution or governance power.

3. Regulatory and Compliance Exposure

Global regulators increasingly monitor social content for potential:

- Unregistered securities promotion or investment solicitation.

- Misleading yield marketing and undisclosed sponsorships.

- Failure to disclose risks clearly to retail audiences.

Crypto organizations should work closely with legal teams to define do/don’t rules for short‑form content and ensure disclosures are visible and spoken on‑screen.

4. Security and Social Engineering

Short videos are also exploited by bad actors:

- Fake airdrop and phishing campaigns via “tutorials”.

- Impersonation of known influencers or protocol teams.

Education‑focused creators should routinely remind viewers: “Always verify URLs. Don’t connect wallets to unknown dApps. Double‑check announcements on official channels.”

Actionable Playbook for Crypto Teams and Creators

Below is a concise, implementable roadmap for any crypto project or independent educator building a micro‑documentary channel around Web3 topics.

- Audit Your Narrative Surface Area

Map everything you could explain in 60s: protocol purpose, tokenomics, roadmap, risks, user journeys. Convert each into a potential episode title. - Prioritize Foundational Education

Start with neutral concepts—wallet safety, gas fees, staking basics—before touching your own token or product. - Design a 3‑Layer Content Funnel

- Top layer: short‑form micro‑docs (awareness, curiosity).

- Middle layer: 5–15 minute YouTube explainers, docs, blog posts.

- Bottom layer: technical whitepapers, GitHub, governance forums.

- Standardize Risk and Compliance Language

Use consistent risk disclaimers in audio, on‑screen text, and descriptions. Review scripts for compliance before publishing. - Instrument for Feedback

Track which videos drive questions about security, KYC, custody, or tax. Use those questions to prioritize your next explainer episodes. - Collaborate with Data Providers

Partner with analytics platforms (e.g., Dune dashboards, Messari profiles) to ensure charts are accurate, cited, and up‑to‑date.

Conclusion: 60‑Second Stories, Long‑Term Impact

Micro‑documentaries on TikTok, Reels, and Shorts are not a fad. They are becoming the default discovery and education layer for a new generation entering crypto, DeFi, NFTs, and Web3. Done well, they:

- Lower the barrier to understanding complex blockchain infrastructure.

- Provide rapid context around fast‑moving market events.

- Build trust in transparent, data‑backed, and risk‑aware communication.

Done poorly, they accelerate hype cycles, spread misinformation, and expose both creators and protocols to legal and reputational risk. The distinguishing factor is discipline: grounding every 60‑second story in verifiable data, explicit risk framing, and clear next steps for deeper learning.

For serious participants in crypto—from builders to professional investors—the strategic move is not to dismiss short‑form video as superficial, but to own the format: build authoritative, accessible micro‑documentaries that make Web3 safer and more intelligible for everyone.