Nvidia's Surprising Stock Reaction: What the Earnings Report Didn't Tell You

The Market's Reaction to NVIDIA's Earnings Beat

While NVIDIA achieved an earnings beat, the market's enthusiasm was tempered as shares dropped 4-5% in after-hours trading. Analysts point to the combination of lofty expectations and minor financial misses that seemed insignificant individually but collectively influenced investor sentiment.

What Experts Are Saying

"Sometimes, the market reaction to earnings isn't just about the numbers; it can be about the emotional narrative the numbers tell." - An Industry Analyst

Industry experts agree that while NVIDIA's fundamentals remain strong, the heightened anticipations set prior to the earnings report set a high bar that was challenging to overcome. The broader market conditions, including tech stock valuations and economic indicators, also played a role in the investor reaction.

Understanding the Underlying Numbers

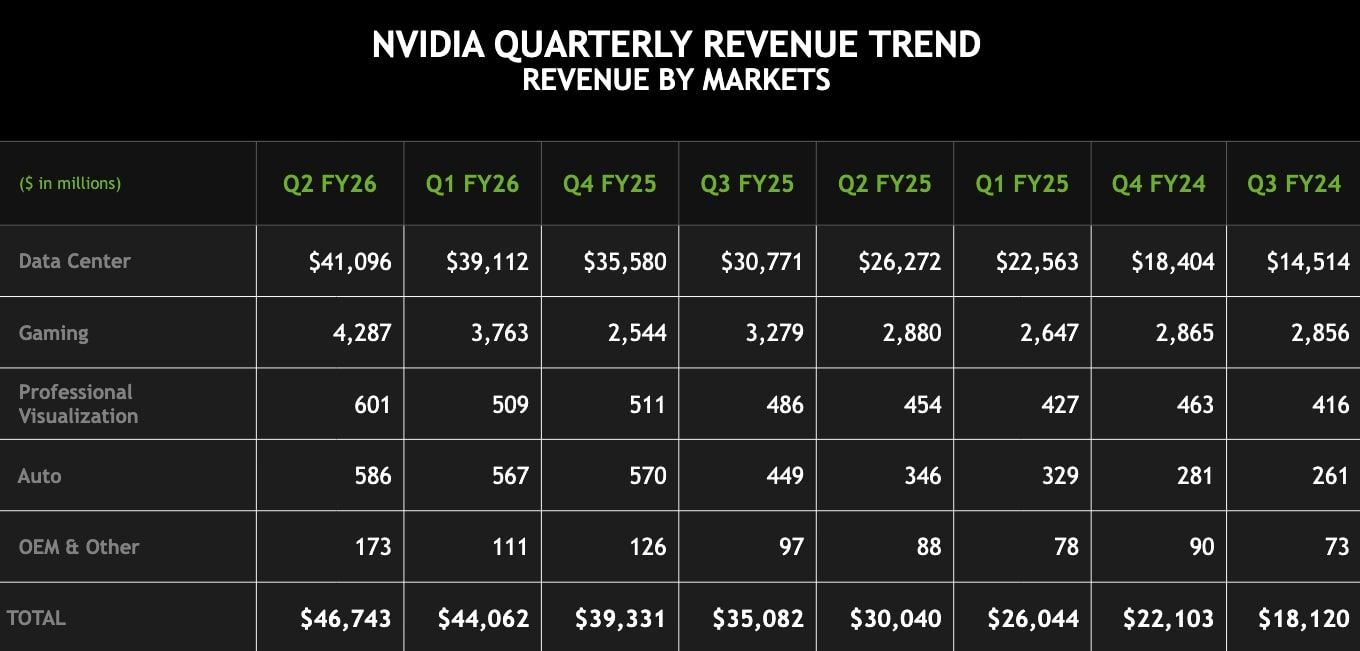

Despite the earnings beat, some areas like anticipated revenue growth slightly missed overly ambitious predictions. Here's a breakdown of NVIDIA's key financial figures:

- Revenue increase by approximately 10%, slightly below projections.

- Earnings Per Share (EPS) exceeded estimates, a positive highlight.

- Strong performance in AI and data center sectors, continuing to lead in technological advancements.

These results, while strong, didn't align with the market's elevated expectations, elucidating why a beat didn't correlate with stock price appreciation.

External Economic Influences

Adding to the mix, broader economic concerns such as inflation and geopolitical tensions might also have contributed to the restrained investor reaction. The tech industry's cyclical nature amplifies these sensitivities, with stock prices susceptible to external economic fluctuations.

Investor Sentiment and Future Outlook

Despite the earnings slip, the long-term prospects for NVIDIA remain robust, bolstered by leadership in AI innovation and strategic growth in data centers. The current stock movement presents both challenges and opportunities for investors looking to capitalize on Jensen Huang's visionary direction.

Where to Next for NVIDIA?

As NVIDIA navigates the complexities of market dynamics, its focus on sustainable growth and technological leadership continues to attract investor attention. By maintaining a strategic balance between innovation and market adaptability, NVIDIA is poised to make significant strides in upcoming quarters.

For further reading, consider exploring NVIDIA Research for the latest in technological advances and market strategies.