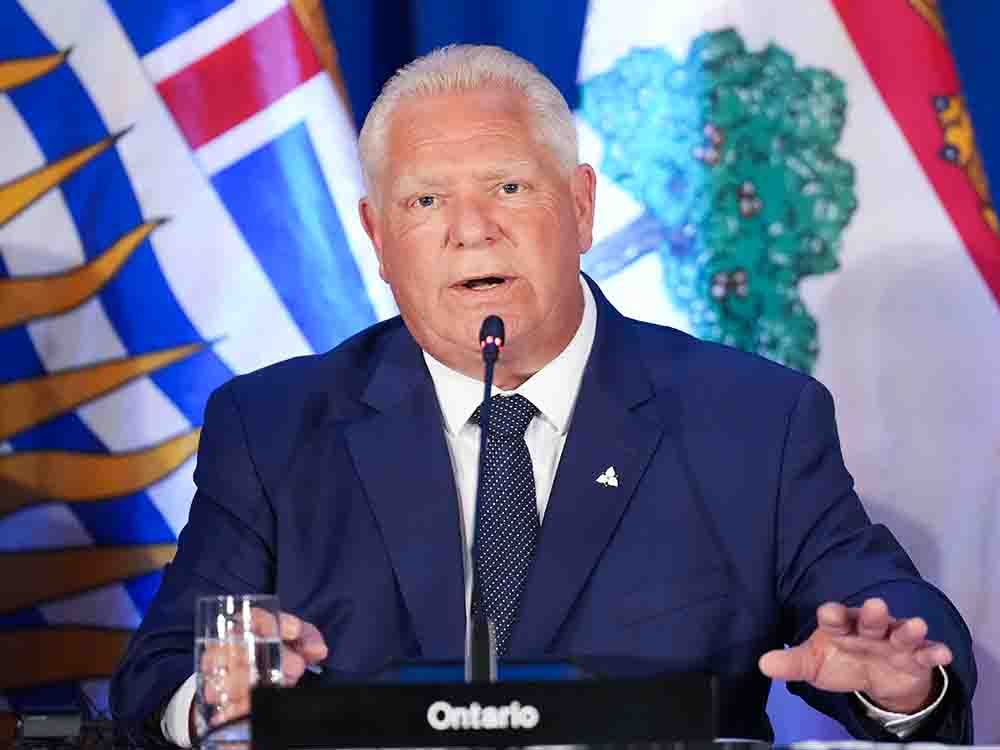

Could Ontario's Premier Doug Ford Be Challenging the Bank of Canada's Independence Once Again?

Doug Ford's Intriguing Move

Ontario Premier Doug Ford took the spotlight with a bold message for the Bank of Canada, blending politics with monetary policy. His call for the central bank to instill "some confidence" has raised eyebrows. Historically, the Bank of Canada operates independently to ensure unbiased financial and economic governance. Now, Ford's intervention puts the focus on the potential implications of politics infringing upon financial prudence.The Importance of Central Bank Independence

The goal of monetary policy is to make sure global markets maintain stability without sudden shocks. — Milton FriedmanIn economies worldwide, central bank independence is key to maintaining healthy economic environments. Such autonomy ensures policies are influenced by economic data rather than political agendas. When leaders like Ford question this independence, it can ripple into market predictions and public trust.

Previous Instances of Political Interference

Interference in central banks' affairs is not new. There have been several instances globally where political figures attempted to sway monetary policies for short-term electoral gains. Such meddling can lead to economic disarray, currency devaluation, and loss of investor confidence.Public Reaction and Economic Predictions

Ford's comments have sparked widespread discussion among economists and political analysts. Here's why:

- Market Confidence: Investors may tread carefully, given the uncertain interplay between politics and monetary policy.

- Inflation Concerns: With looming inflation fears, confidence in central bank decisions becomes even more crucial.

- Political Dynamics: Ford’s stance may be challenging federal financial policies, precipitating potential political clashes.

What This Means for Everyday Canadians

For everyday citizens, the stability and confidence in the Bank of Canada translate to personal financial security. Impacts could range from mortgage rate shifts to uncertainties in investment returns. Hence, the topic attracts significant public interest and speculation. For detailed insights into how central bank policies affect personal finance, [visit here](https://www.amazon.com/Your-Economy-Betters-Finances-Foundation/?&linkCode=ll2&tag=currenttre04f-20&linkId=267bd924da26b6db10d01e8be3f947db).Engage with Industry Experts

Curious what the industry pundits are saying? Analysts on platforms like LinkedIn and Twitter are sharing their expertise. Follow insightful discussions by [economist Stephen Gordon](https://twitter.com/sgoodnocanada). Engage with posts and articles debating the potential road ahead for Canada's financial regulations and political strategies.

Continue Reading at Source : Financial Post

Tags:

Politics