Fed's Stand on Interest Rates Amid Trump's Push for Cuts

The Fed's Approach: A Strategic Wait-and-See

The Federal Reserve's decision to hold interest rates steady amid President Trump's persistent calls for cuts demonstrates a strategic measure in assessing economic conditions. The central bank has adopted a prudent wait-and-see approach, keen on observing the repercussions of ongoing trade negotiations and economic indicators before making impactful moves.

Trade Wars and Economic Uncertainty

In recent months, the trade war initiated by President Trump has sent ripples across the global economy, sparking uncertainty. The Fed has its eye on these developments, understanding that abrupt rate adjustments could exacerbate financial instability. Relationship between Trade Policies and Economic Stability .

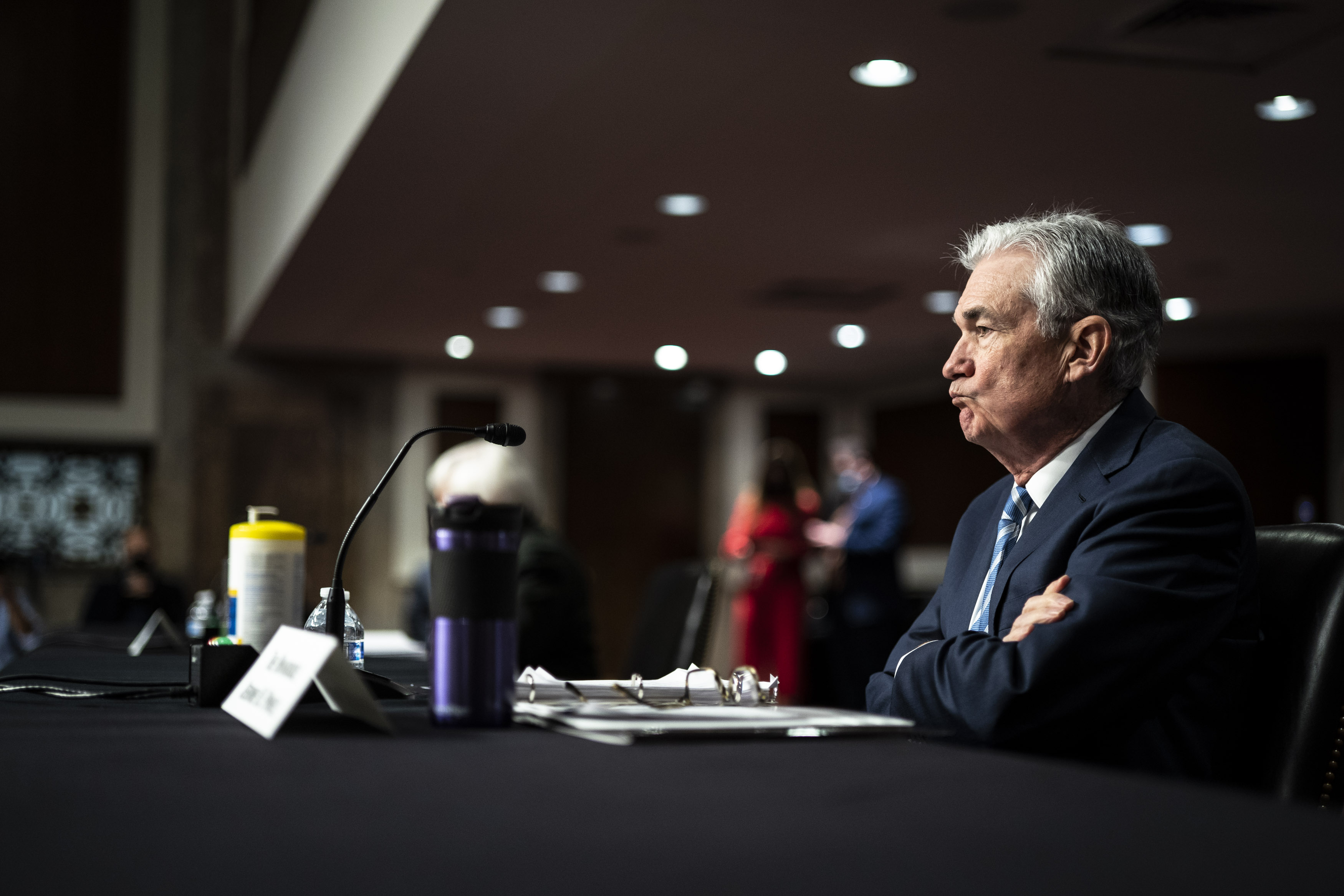

"In the short run, there's always some uncertainty... We need to focus on the long-term impacts on the economy," remarked Jerome Powell, Chair of the Federal Reserve.

Balancing Economic Growth and Inflation

One of the Fed's primary mandates is to manage inflation while fostering economic growth. By holding rates steady, the Fed aims to strike a balance between these objectives, ensuring that the U.S. economy does not overheat or stall.

Market Reactions and Forecasts

Financial markets pay keen attention to the Fed’s signals. The decision to maintain current rate levels calms investors who fear volatile market swings. Analysts predict a more stable financial landscape, at least in the short term.

- Stability in stock markets

- Encouragement of cautious consumer spending

- Stabilization of mortgage rates supporting the housing market

Global Perspectives and Comparisons

Examining international economic frameworks provides additional insight into the Fed's choices. Developed nations often influence each other's monetary policies, creating a delicate balance in global finance Global Economy Insights .

Consumer Impact: What This Means for You

For consumers, stable interest rates can signify a continuation of current economic conditions without abrupt changes in loan or credit costs. It encourages spending while providing a secure environment for economic activities. Explore Books on Economic Decisions .

The Road Ahead

As we tread through 2023, the Federal Reserve's decisions remain pivotal in shaping the U.S. and global economic landscapes. With a commitment to data-driven policy, the Fed's path reflects both the complexities and the opportunities within the current economic milieu.

Related discussions on financial strategies can be found: CNBC's Insights on Fed Policies . Additionally, stay updated with: Federal Reserve's Twitter Updates .